Humans always have had a strong belief in the metaphysical powers of precious stones especially diamonds. People own and wear them to change their lives, their fates and their relationships for the better. There is an entire school of thought based on a principle that gemstones have strong healing properties for both mental and physical health. Mostly, only fortunate outcomes are attributed to gems.

Beauty can be a gift and a curse—and that we can say about diamonds. There are many of those precious gemstones that have a dark and spookier side. If we delve into past chronicles, we can find several diamonds that were believed to be cursed. The owners and wielders of these stones have met some ill-fated ends. In this article, we are going to discuss some of the most famous cursed diamonds from the archives of history.

The Hope Diamond

The Hope Diamond

“The Hope diamond”by Arenamontanus is licensed under CC BY-NC 2.0![]()

![]()

![]()

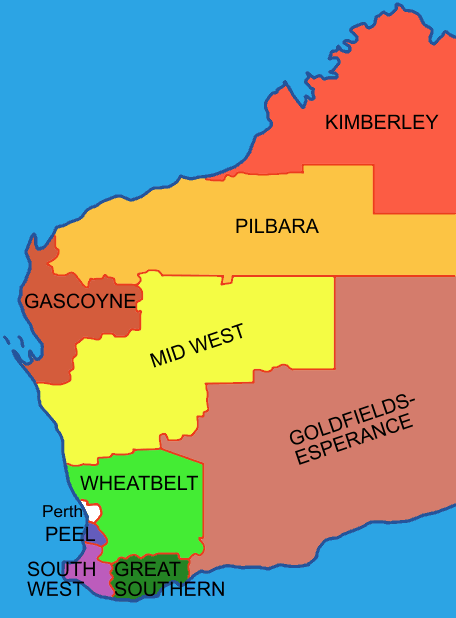

In the list of cursed stones, no other diamond has gained more notoriety than the hope diamond. This 45-carat gem with blue undertone has been around for at least four centuries with an unknown first owner. There is a long index of tragedies and mishaps for which the Hope Diamond has been blamed.

From insanity to murders and suicide, the hope diamond has brought the excessive of calamities for its owners and their loved ones. The most famous ‘victims’ of the hope diamond were King Louis XVI of France and Marie Antoinette. The couple owned the Hope Diamond during the infamous French turmoil and subsequent revolution. Louis XVI was the owner of the Hope Diamond at the time of his beheading.

Evalyn McLean, an American Socialite from the early 20th century was the last private owner of this cursed diamond. McLean had to go through a series of tragedies during her ownership of the stone—her husband left for another woman, her son died in a car crash and her daughter committed suicide.

Famous American Jeweler Harry Winston bought the stone from a Mclean’ estate trustee after her death and eventually sold it to Smithsonian, a museum and a research institute in Washington DC. To this day, it is the property of the museum and anybody can see that cursed stone that has been blamed to cast its evil spell on its owners throughout history.

The Koh-I-Noor

“He who owns this diamond will own the world, but will also know all its misfortunes. Only God or a woman can wear it with impunity.” These chilling words were said about the infamous 109-carat Koh-I-Noor diamond, originally mined some 5,000 years ago. The stone has a bloodied past marred with battles between entire monarchs.

The stone was passed out among Persians, Indians, and Afghans as they would overpower each other in wars. The stone was eventually shifted to Britain and the Royal Family when the East India Company defeated the Sikh Emperor in India, the owner of the stone at that point in time.

The British were well-aware of the jinx and evil associated with the male ownership of Koh-I-Noor and how it had brought down the empires. Therefore, Queen Victoria wrote in her will that the stone must only be worn by a female royalty.

The Koh-I-Noor is now a part of the Crown Jewels. Iran, India, and Afghanistan still argue that they are the rightful owner of this cursed diamond.

The Black Orlov

It is the curse story of a black diamond that was once the eye of a statue of Hindu God Brahma. It was stolen by an unknown miscreant somewhere in the 19th century. From then on, this black diamond has remained a cursed stone. It is believed that the priest of the temple put a vicious curse on the owner of the stone.

Before the Bolshevik Revolution, a Russian princess Nadia Vyegin Orlov was the owner of this black diamond. The princess committed suicide by jumping off the balcony while the stone was still part of her pendant. The stone then unknowingly found its way into the hands of an American diamond dealer J.W. Paris. Paris also took his life by jumping off a building, in an uncannily similar manner as Princess Orlov’s suicide.

The stone is now in the private ownership of a Pennsylvania-based ornament dealer Dennis Petimezas. He strongly contests that the curse of the Black Orlov has been broken. It is interesting to note the many owners have cut the stone into new shapes to ward off its curse. The original black diamond was over 190 carats and now it has been tapered to just 67 carats. However, the frequent ownership shift suggests that the curse hasn’t been broken yet.

The Regent Diamond

The Regent Diamond was another cursed stone with its origin in India. It was mined from the Goloconda Mine, located in Hyderabad, India. Shortly after its excavation, it was stolen by a slave who then boarded a ship to France to sell it and to start a new life.

He hid the stone in his leg wound to protect it from getting stolen or snatched. Whether due to stone’s curse or something else, the ship’s captain found out about it. The captain had the slave killed and went on to sell it for himself.

The stone eventually ended up in one of Napoleon’s swords. Many people believe that the possession of the Regent Diamond was the starting point of Napoleon’s decline. The Regent Diamond is now on display at the famous French museum the Lourve.

The Sancy Diamond

The Sancy diamond is a 55-carat crystal with yellow undertones. A French soldier acquired the stone from India and sold it to a British royalty who wore it as a good luck charm. The stone is believed to be cursed because of its frequent disappearance all through history.

One time, the diamond went missing and eventually found its way in the stomach of a messenger who died of unknown circumstances. This stone is now also part of the jewel collection in the Louvre alongside the Regent Diamond.

From a scientific standpoint, it’s just a superstition to believe in the curse of diamonds. But there is no denying that the owners of these cursed diamonds had to go through some ill-fated instances. Coincidence?

The Hope Diamond

The Hope Diamond

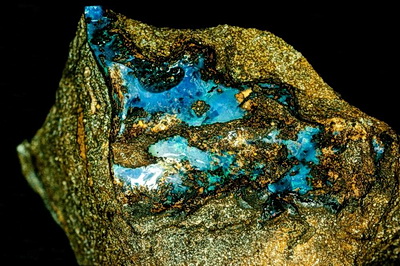

Silver is perhaps the most overlooked precious metal, as most people tend to focus more on gold and platinum. However, it has most of the same properties as gold, and even offers important technological and electronic applications.

Silver is perhaps the most overlooked precious metal, as most people tend to focus more on gold and platinum. However, it has most of the same properties as gold, and even offers important technological and electronic applications.

Photo

Photo